new market tax credit map 2020

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225. The NMTC has supported more than 5300 projects in all 50 states the District of.

New Markets Tax Credit Investments In Our Nation S Communities

Generated 8 of private investment for every 1 of federal funding.

. 1 2018 must use 2011-2015 ACS low-income community eligibility data applied to the 2010 census tracts for. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants.

CIMS4 users can create and save maps and reports including Target Market worksheets and submit saved maps and. These are identified by the federal government as having unemployment greater than 15 times the national average and those areas with median incomes less than 80 of the state or metropolitan area. 2020 NMTC Award BookSep.

The 2011-2015 data is displayed by default. 95091 the department shall direct the Department of Revenue at any time before Dec. The New Markets Tax Credit NMTC was designed to increase the flow of capital to businesses and low income communities by providing a modest tax incentive to private investors.

1 20212020 Evaluation ProcessSep. 31 2017 with a one-year transition period in which applicants can alternatively choose to use 2006-2010 data. Your project may be eligible for the Program based on its location in a qualified census tract.

This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and 2006-2010 American Community Surveys. As of the end of FY 2020 the NMTC Program has. 95091 the department shall direct the Department of Revenue at any time before Dec.

New Markets Tax Credits. It also modifies the credit to 1 provide for an inflation adjustment to the limitation amount for the credit after 2021 and 2 allow an offset against the alternative minimum tax for the credit determined with respect to. Louis Economic Development Partnership.

This bill makes the new markets tax credit permanent. This mapping tool was created to provide prospective applicants with the ability to search by address census tract and other geographic areas of interest to determine program eligibility for the BEA CDFI CMF NACA and NMTC programs. Calendar year 2020 new markets tax credits allocations including the NMTC award book and review process information.

The new data can be used beginning Oct. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. The CDFI Information Mapping System v4 CIMS4 is now available for geocoding addresses mapping census tracts and counties and determining the eligibility of census tracts and counties under the CDFI Funds various program distress criteria.

1 2021CY 2020 Allocation Agreement TemplateJune 14 2021. The CDFI fund provided the allocation availability notice PDF 209 KB which is scheduled to be published in the Federal Register on September 23 2020. From 2003 through 2020 the program has parceled out credits worth 26 billion in 2020 dollars.

Introduced in House 02252021 New Markets Tax Credit Extension Act of 2021. Address Social Media. The NMTC allocation for the 2020 round is set at 5 billion in tax credit allocation authorityan increase of 15 billion over the 35 billion allocated in NMTCs initially authorized for 2019.

The New Markets Tax Credit is taken over a 7-year period. This program was established to incentivize the use of the NMTC program in the States underserved and underdeveloped areas. When a user clicks on the map the info bubble displays values based on the 2011-2015 eligibility data.

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225. These investments will create jobs and spur economic growth in urban and rural communities across the country Secretary of the US. Over the last 15 years the NMTC has proven to be an effective targeted and cost-efficient financing tool valued by businesses communities and investors.

31 2017 the CDFI Fund released updated 2011-2015 American Community Survey ACS low-income community LIC data for the New Markets Tax Credit NMTC program. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. Both sets of data2006-2010 data and 2011-2015 American Community Survey ACS low-income community LICwill be available in the NMTC Mapping Tool.

-Jeffrey Frankel AVP New Markets Tax Credits St. The NMTC program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified Community Development Entities CDEs. New Markets Tax Credit Resource Center.

Awards will Spur Economic and Community Development Nationwide WASHINGTON The US. The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. A total of 100 Community Development Entities CDEs were awarded tax credit allocations made through the calendar year CY 2020 round of the New Markets Tax Credit Program NMTC Program.

State-of-the-art community facility in Watts for the Childrens Institute is expected to begin in January 2020 and. Total credit equals 39 of the original amount invested in the CDE. The federal government recaptures any portion of the federal NMTC.

The New Markets Tax Credit NMTC was established in 2000. The Community Development Financial Institutions CDFI Fund this week sent a letter to new markets tax credit allocatees with calendar year CY 2015-2020 allocation agreements announcing a change to extend the 36-month lookback period to Dec. Use the search bar to type an address and view eligibility information on the map.

Projects closed on or after Nov. 5 of the original investment amount in each of the first three years. Address Social Media.

All too often the cost to construct facilities far outweighs traditional sources operator experience and guarantees are absent andor newer technologies and social service models present cash flow challenges but for NMTCs. Department of the Treasurys Community Development Financial Institutions Fund CDFI Fund announced 5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide. New Markets Tax Credit Benefits.

Wednesday May 4 2022. The NMTC program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified. The lookback period previously included transactions closed by May 31.

To get started choose one of the programs below. The credit rate is. 2020 NMTC Award Book.

To change the time frame to 2006-2010 click. 2020 - Round 17 Allocations. The Community Development Financial Institutions CDFI Fund this week sent a letter to new markets tax credit allocatees with calendar year CY 2015-2020 allocation agreements announcing a change to extend the 36-month lookback period to Dec.

31 2022 to recapture all or a portion of a tax credit authorized pursuant to the New Markets Development Program Act if one or more of the following occur. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393. New Markets Tax Credit.

And 6 of the original investment amount in each of the final four years. Either census database may be used to evaluate eligibility through a transition period ending October 31 2018.

Global Carbon Account In 2020 I4ce

Where Carbon Is Taxed Overview

Think Tanks Reports On Covid 19 And The Recovery Fund Consilium

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

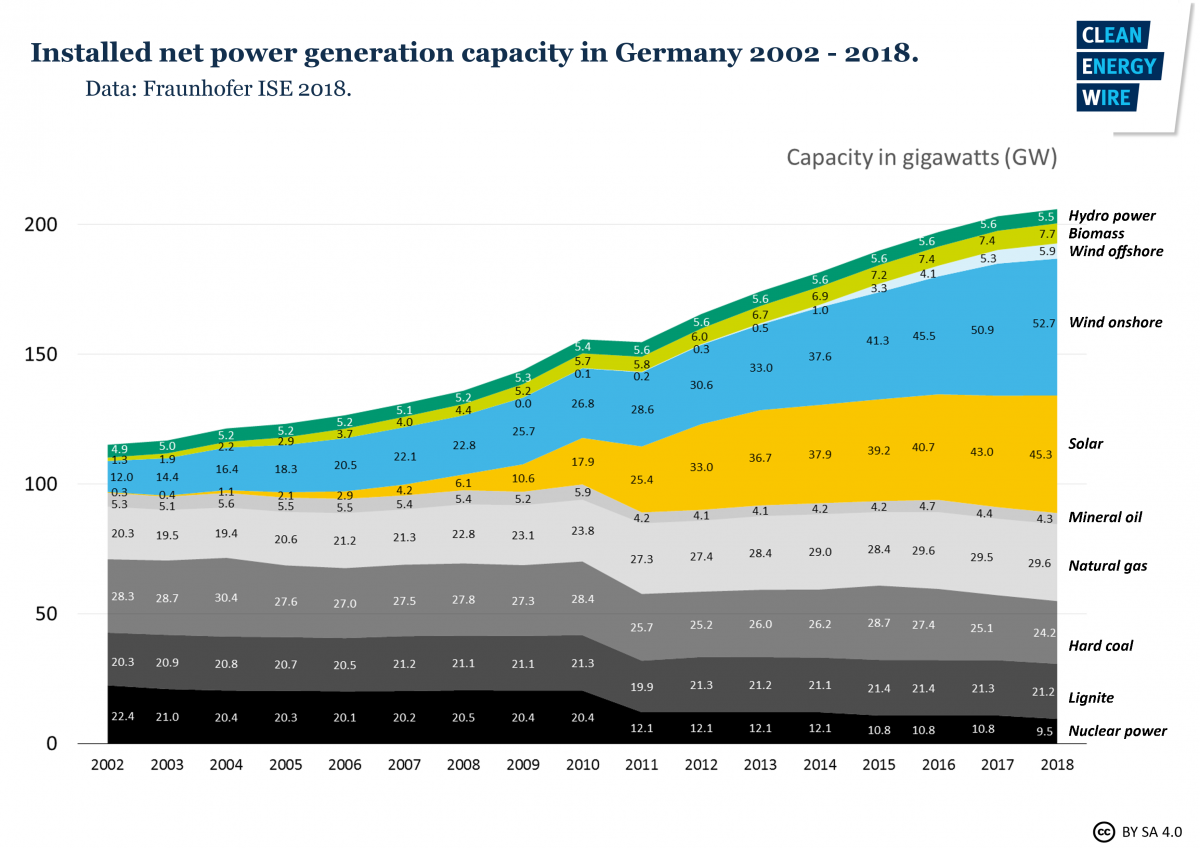

20 Years On German Renewables Pioneers Face End Of Guaranteed Payment Clean Energy Wire

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

New Markets Tax Credit Investments In Our Nation S Communities

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Germany S Carbon Pricing System For Transport And Buildings Clean Energy Wire

Welcome To The Cdfi Fund Cims Mapping Tool Community Development Financial Institutions Fund

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Dlr Earth Observation Center Home

Think Tanks Reports On Covid 19 And The Recovery Fund Consilium

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Mapping Research And Innovation In The Republic Of Uzbekistan

New Markets Tax Credit Investments In Our Nation S Communities

What German Households Pay For Power Clean Energy Wire

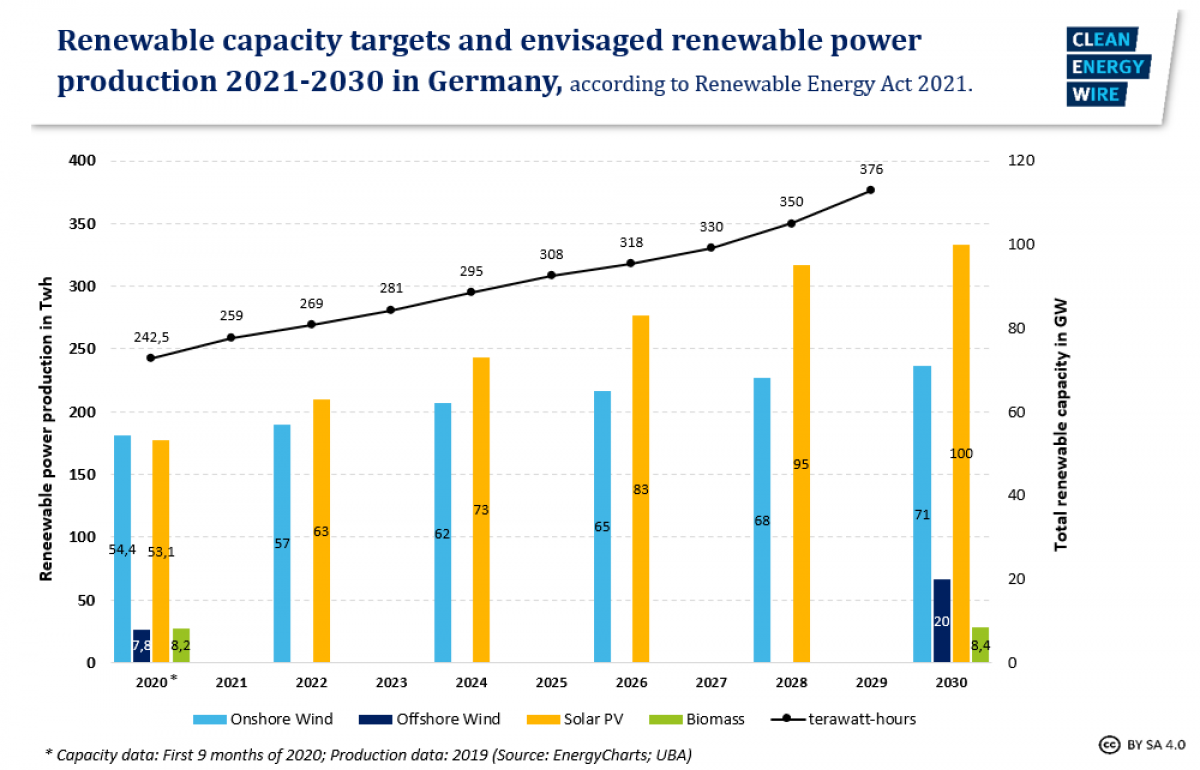

What S New In Germany S Renewable Energy Act 2021 Clean Energy Wire